What You Should Know About E-Invoicing

Digitalized invoicing processes promise huge cost savings of between 60 and 80 percent compared to paper-based invoicing processes. The benefits of switching to e-invoicing include reduced entry errors, shortened processing times and an increase in cash discounts. Increasingly, e-invoicing is also becoming a legal obligation (e.g. European Directive 2014/55/EU).

But what exactly is an electronic invoice, what are the challenges in e-invoicing, what components should an e-invoicing solution have and what is Peppol? The following guide to e-invoicing answers these questions and more.

What Is an Electronic Invoice?

An electronic invoice is an invoice that is issued, transmitted and received in an electronic format. A distinction is made between:

- structured data (e.g. EDI, XML),

- unstructured data (e.g. invoices in PDF, TIF, JPEG, Word format or e-mail text)

- hybrid data (e.g. ZUGFeRD or Factur-X).

The available transmission/reception channels include e-mail, DE-Mail, computer fax, fax server, web download, Peppol or web service. Invoices received in paper form and converted to electronic formats do not fall under the definition of electronic invoices under the VAT Act.

It is not very efficient to print, envelope, stamp and send a digital invoice on paper only to have it manually captured and digitized again by the recipient before it can finally be paid.

Such an invoice process is complex, expensive and not environmentally friendly due to the use of paper and transportation resources. Due to this, German legislation has placed the electronic invoice on an equal footing with the paper invoice (01 July 2011). Since then, electronic invoices have been sent without an electronic signature and, for example, by e-mail.

In response to the European Directive 2014/55/EU the legislator defines an electronic invoice in the Act to promote electronic government (E-Government Act - EgovG) as follows:

An invoice is electronic if:

- it is issued, transmitted and received in a structured electronic format and

- the format enables the invoice to be processed automatically and electronically.

Source (translated): §4a Para.2 German EGovG

Sending invoices as PDF files does not meet these requirements, because the recipients cannot automatically process PDF files. Businesses expect to receive electronic invoices in a structured format that can be understood automatically.

Structured invoice formats with Electronic Data Interchange (EDI) data are not readable by humans. Recipients must visualize structured electronic invoices for internal invoice verification, release and subsequent archiving.

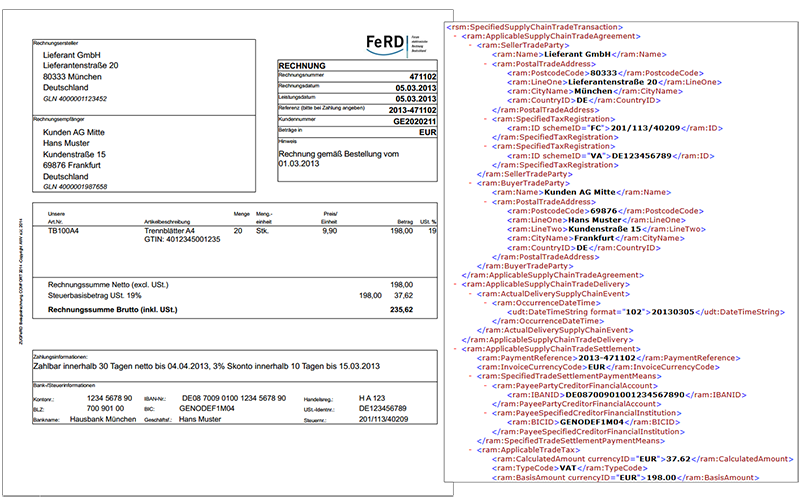

Hybrid invoice formats avoid this disadvantage by combining the machine-readable structured format and the human-readable visual representation. Technically, this can be achieved by embedding an XML structure in a PDF file. The following figure 1 shows, for example, a ZUGFeRD invoice containing a human-readable PDF with structured invoice data in an XML format.

Digitalization with E-Invoicing – Future-Proof into the Digital Age

"It's difficult to make predictions, especially about the future." This quote by Mark Twain also applies to e-invoicing, except that it is a matter of "when” and not “if” electronic invoicing will replace paper invoicing on a large scale.

The European Commission has already done everything necessary to encourage the move away from paper invoices by gradually making e-invoicing mandatory. Whereas in the European Union in 2017, 70 % of all invoices were still exchanged on paper and 22 % in the form of PDF files that cannot be processed electronically, the tide has been turning. Structured and hybrid invoice formats now account for more than 50 % of invoices. The prediction is that this trend will continue and the number of paper invoices and PDF invoices will be reduced to a bare minimum.

Germany is by no means one of the pioneers when it comes to e-invoicing. The southern and eastern EU countries, such as Italy, Spain, Croatia and Hungary, are outpacing Germany in the implementation of the European Directive 2014/55/EU. Nevertheless, electronic invoicing in public administration has also become widely accepted in Germany since 2020 and 2021, and companies are well advised to equip themselves promptly with appropriate digital solutions for e-invoicing, if they have not already done so.

- Since 1 July 2011, invoices can also be transmitted without an electronic signature by email or e-invoicing. You can use digital signatures but are not required to. Since 1 July 2011, paper and electronic invoices are to be treated in the same way for VAT purposes.

- 26.06.2013: Proposal for EU Directive

- 16.04.2014: Directive on electronic invoicing for public contracts

- From 2018, public administrations must accept and process e-invoices (B2G).

- From 2020, e-invoices will also become mandatory between companies (B2B), and the federal government and certain federal states.

The Biggest Driver on the Subject of E-Invoicing Is the Government

Are you a public sector supplier? Is your company internationally active? If your answer is yes to either question, it is very likely that you will need to send invoices electronically, either now or in the near future.

Despite the enormous cost savings potential through the digitalization of incoming and outgoing invoices, governments are the driver of e-invoicing.

The EU standard 2014/55 regulates e-invoicing for public contracts and required more than 300,000 public administrations in EU countries to be ready for e-invoicing since November 2018, in terms of systems, and since November 2019, in terms of processes. Since 45 to 65 percent of all companies in a country are typically public sector suppliers, the aforementioned EU standard is predicted to be the driving force behind e-invoicing. However, unstructured e-invoices are not electronic invoices within the meaning of this Directive.

24 out of 27 EU countries (as of February 2020)

- have implemented a solution for electronic invoicing in the B2G sector,

- offered suppliers electronic invoicing or

- already requireed a solution for electronic invoicing in the B2G sector.

More and more countries are demanding e-invoicing: The main reason for the growing number of invoicing or e-invoicing regulations is trivial.

Governments are increasingly looking for new ways to enforce their tax laws and collect more of the expected VAT. The VAT GAP Report 2022 shows that EU member states are estimated to have lost €93 billion in VAT revenue in 2021 - or in relative terms, 9.1% of total expected VAT. The so-called tax gap between the expected VAT (also known as the VAT Total Theoretical Liability, abbreviated as "VTTL") and the actual VAT collected is likely to continue its downward trend.

In view of strained national budgets and flattening economic growth, the motivation in the EU member states to actually collect more of the expected tax will certainly increase further.

The easiest way for the EU member states to do this is by requiring companies that operate within their national borders to provide all invoices electronically and, as is already the case in some countries, to report either the entire invoice, or at least the VAT information, electronically to the tax authorities in real time.

E-Invoicing Study

Download the results of the study from the SEEBURGER E-Invoicing PLUS Autumn Series 2020

Download studyWhat Are the Advantages of E-Invoicing?

The main advantage of e-invoicing lies in the enormous cost savings. Printing and shipping costs are eliminated, invoices can be delivered faster and errors in incoming invoice processing are reduced. If there is an order reference to an incoming invoice, the invoice can be booked fully automatically. In addition, e-invoicing shortens the time from invoicing to payment and thus increases liquidity of the supplier and increases the chance for the customer to meet the requirements for a trade discount.

All the advantages of e-invoicing at a glance:

E-Invoicing for Outgoing Invoices

The creation and delivery of paper invoices are highly manual and inefficient business processes for suppliers. These processes result in high costs, errors and late payments.

E-invoicing for outgoing invoices optimizes these internal processes, saves costs, increases the transparency of internal processes and improves the environmental footprint. Companies can improve their customer loyalty and secure market opportunities and competitive advantages.

The process of digital invoice delivery can be divided into four simplified steps: entry, preparation, portal and transfer/export.

After the invoices have been created with an ERP system, the outgoing invoices are automatically transferred via an interface to the e-invoicing solution for digital outgoing invoices.

Depending on the e-invoicing standard (e.g. ZUGFeRD), the received invoice data is converted into the desired format.

In a portal application, the outgoing invoice book can optionally be viewed centrally and an audit-proof archive can also be connected.

In the last step, the electronic invoice is sent to the invoice recipient, for example by email as an attachment or as a secure download link. A connection of invoice recipients via EDI (EDIFACT) is also a common approach.

By using an e-invoicing solution for outgoing invoices, manual outgoing invoice processes are eliminated and the time for invoices to become due is considerably shortened by immediate delivery.

Electronic outgoing invoices made easy!

You create the invoices and we take care of everything else

Download brochureE-Invoicing in Invoice Receipts

The processing of incoming invoices is in a continuous, automated process from the recording of invoice receipts to the final posting:

The digital invoice receipt process can be categorized into three steps: receipt, preparation and processing.

Receipt: The invoices are automatically received via different input channels.

These are:

- EDI invoices

- Hybrid invoices (e.g. ZUGFeRD)

- PDF invoices

- Scanned paper invoices

Preperation

After invoice receipt, the invoice contents are converted into an internal standard. Electronic invoices, which already contain structured data, are converted. Scanned paper invoices and PDF invoices are identified and extracted using OCR/text recognition software.

Processing

The prepared invoice data is enriched with master and order data from the ERP system and automatically checked for order reference, quantity and price deviations or country-specific rules. At best, invoices can be automatically transferred for posting. All other invoices must be routed to an integrated clarification or approval process.

All steps that an invoice goes through in the verification process are logged. The invoice content required for the booking is transferred to the customer's ERP system. The invoice, attachments in the editing process, conversion and editing protocols must be archived in a revision-proof manner in accordance with the applicable national requirements.

Electronic invoice receipts made easy!

Benefit from end-to-end digitization of your invoice processes in no time at all

Download brochureGlobal E-Invoicing

Internationally active companies are increasingly required by government regulations to create and send their invoices electronically. However, different legal regulations apply in each country. E-invoicing regulations already exist in more than 65 countries worldwide, and that number is growing.

In many countries, the heterogeneity of the respective regulations and local specifics in the context of e-invoicing, related to accurate and up-to-date data, security requirements, system integration, status monitoring and documentation lead to high complexity. There are basically two types of audit models for electronic invoicing, commonly known as clearance and post-audit models.

Post audit: The regulations of the individual countries specify a minimum period over which electronic versions of invoices must be stored for possible automated auditing. Currently, the post-audit procedure is still predominantly used in the EU.

However, the move away from the highly time-delayed post-audit process and reorientation towards a centrally regulated e-invoicing model and real-time and near real-time transaction-based tax reporting and controls (clearance processes, also known as Continuous Transaction Controls 'CTC') are becoming increasingly entrenched in the EU.

Continuous Transaction Controls to reduce the tax gap

Combating tax fraud and tax evasion under simultaneous pressure of stagnant economic growth, rising government spending and inflation increases the motivation for EU members to rapidly implement Continuous Transaction Controls ("CTC" or "CTCs").

Real-time e-invoicing and e-reporting are expected to reduce the €134 billion tax gap in 2019 (European Commission VAT Gap Report of 2021) in the future.

EU-wide standardization and harmonization of CTCs by 2023

In a plenary session on March 10, 2022, the EU Parliament called on the EU Commission to immediately implement an EU-wide, harmonized e-invoicing standard by 2022. E-invoicing is to play a defined role in real-time e-reporting and an e-invoicing obligation is to be successively introduced by 2023 in order to significantly reduce the compliance costs of companies through state-operated or certified systems.1

This effort towards EU-wide standardization and harmonization of CTCs in e-invoicing and e-reporting is very welcome.

Lack of cross-country CTC standards in practice

To the chagrin of many multinationals, the clearance procedures have so far varied greatly from country to country. This is because the focus of existing CTC models is mostly on the domestic market, and serves first and foremost the state interest of tax optimization. Subordinately, existing CTCs take into account the following aspects, for example:

- User friendliness

- Support of indirect tax controls for cross-border and transnational operations

- Harmonization for reusability for other countries by applying existing format standards, exchange and interoperability

- Business acceleration and supply chain optimization through efficient end-to-end integration of electronic invoice data as it is created, exchanged, received and processed across all sizes of organizations

Trend towards the introduction of CTC systems

The trend toward CTC requirements is gaining momentum. With CTCs, countries require business entities to report invoice data directly from their transaction processes to tax authority systems and portals to supplement or even replace regular VAT returns. E-invoicing and electronic reporting requirements, the so-called "e-reporting" of invoice data in (near) real time to the tax administration for reporting purposes, are often referred to as continuous transaction controls (CTC) and transaction-based tax reporting. These real-time controls on transaction-based reporting often include digital signatures, unique document reference numbers and QR codes. CTC requirements for economic operators exist in Mexico, Brazil, Italy, Turkey, Portugal, Spain and Hungary, for example.

In Europe and Asia, the CTC trend, which originated in Latin America, has only just begun.

Existing e-invoicing and CTC models

Existing e-invoicing and CTC models can be categorized as follows, as outlined by a group of experts in the document “A Next Generation Model for Electronic Tax Reporting and Invoicing":

- Interoperability Model

- Real-time Invoice Reporting Model

- Clearance Model

- Centralised Exchange Model

- Decentralised CTC and Exchange

The following examples illustrate the process of reporting VAT data and exchanging e-invoices.

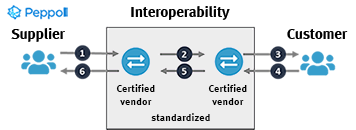

Interoperability Model

The exchange of invoices between trading partners is standardized across formats, content, subscriber directories, exchange protocols and interoperability criteria between certified providers. There is no involvement of the tax authorities or their platform, as in the traditional Peppol 4-corner model, for example.

Real-time Invoice Reporting Model

The taxable entity reports the invoice or a subset thereof to a government agency shortly after the invoice is issued and exchanged between trading parties. The exchange of invoices between trading parties is not regulated.

Clearance Model

The invoice is checked and cleared via the tax authority's central platform. If applicable, only certified providers are allowed to perform the communication with the platform. The exchange of invoices between trading partners is not regulated.

Centralised Exchange Model

Verification, clearance and exchange of the invoice are carried out via the central platform of the tax authority.

Decentralised CTC and Exchange Model: “DCTCE”

As with the Interoperability Model, the DCTCE model relies on a decentralized network of certified providers that provides for user-friendliness, investment protection, interoperability, reusability of solutions in other countries and connectivity to tax administrations' platforms that may already exist or be under development, ensured by the certified providers. An example of a DCTCE model is the new Peppol Continuous Transaction Controls Reference Model. This is a Peppol-based 5-corner model, which combines interoperability (known from the classic Peppol 4-corner model with the four corners: 1. supplier, 2. access point from the supplier, 3. access point from the customer, 4. customer) with the connection of the control platforms (corner no. 5) in one model.

International regulations are changing at a rapid pace. The number of countries that require some form of e-invoicing is constantly increasing, and the numerous regulatory details of individual countries that need to be taken into account increase the complexity of e-invoicing for internationally active companies.

One of the biggest challenges in international business is keeping up with regulatory changes. Our blogs about country-specific regulations are always up to date:

| Austria | There is a legal obligation for all B2G suppliers based in Austria to transmit their invoices in electronic form in accordance with the Austrian ICT Consolidation Act (IKTKonG). The national XML invoice standard for Austria is ebInterface. |

| Belgium | A draft law creates conditions for a B2B e-invoicing mandate in Belgium. This obliges counterparties to send, receive and process e-invoices. |

| Brazil | Brazil introduced a total clearance model for e-invoicing back in 2005. Before suppliers can issue an invoice to their customers, they must first transmit it to an "ok-to-issue" clearance platform of the tax authorities. |

| Europe | On March 10, 2022, the European Parliament (EP) adopted in plenary a resolution on the European Commission's (EC) Action Plan for Fair and Straightforward Taxation in Support of Economic Recovery Strategy (2020/2254(INL)). In 2022, the Commission presented the first draft on ViDA. |

| Finland | Since 2010, the use of business-to-government (B2G) e-invoicing has even been mandatory in Finland. The country relies on the specific formats Finvoice and TEAPPSXML as well as a 4-corner delivery model. |

| France | France plans to extend the current B2G e-invoicing mandate to B2B invoices. The obligation will take place in several waves and will be based on the size of the company. From a certain date, CTC B2B e-invoicing and e-reporting will become mandatory for all companies. Invoices to government (B2G) will be sent via the Chorus Pro platform. Learn more in our white paper. |

| Germany | Since November 2020, the use of XRechnung in the B2G sector has been mandatory in Germany. |

| Greece | Contracting authorities in Greece have been obliged to accept invoices in an EN-compliant format since 2020. E-invoices must be sent to the MyDATA platform. Recognized formats for invoices to the federal government are PEPPOL-UBL and ebInterface. |

| Hungary | In Hungary, the electronic VAT reporting of outgoing invoices to the Hungarian tax system NAV (National Tax and Customs Administration, NTCA) has been mandatory under certain conditions since 2018. The National Tax and Customs Administration of Hungary (Nav Nemzeti Adoes Vamhivatai, in short: NAV) offers the online szamla system (IT system/procedure of the Hungarian tax authority) for these reports. |

| India | Since 2020, it has been mandatory to use the e-invoicing reporting system in India. It is based on the new Invoice Reporting Portal (IRP) for the registration of domestic B2B and B2G invoice transactions and export invoices. Since 2022, all taxpayers have to ensure B2B e-invoicing. |

| Italy | Since 2019, all domestic invoices in Italy must be issued in a defined electronic format (FatturaPA) and exchanged via a government-operated invoice portal (SdI). Italy went one step further in 2022 by introducing the "Crossboarder Invoice." Invoices sent from Italy to another EU state or received in Italy from another EU state are subject to VAT reporting to the invoice portal (SdI). In 2020, Italy created the e-order mandate through the NSO platform, which is mandatory for suppliers of the national healthcare system. |

| Japan | In 2022, the Japanese E-Invoice Promotion Association (EIPA) joined the Peppol network. Starting October 1, 2023, a new electronic invoice system for the purpose of input tax deduction will apply. |

| Luxembourg | Since 2023, the obligation for B2G e-invoicing applies to companies of all sizes. The Peppol BIS Billing 3.0 standard is used to create a uniform basis for the exchange of invoice data. |

| Mexico | Since 2017, Mexico has had CFDI version 3.3 in use without any modifications. The term CFDI stands for "Comprobante Fiscal Digital por Internet", which translates as "digital tax certificate via the Internet." |

| Poland | In Poland, B2G e-invoicing has been mandatory for suppliers since 2020. In January 2022, the KSeF platform ("Krajowego Systemu e-faktur") started in Poland on a voluntary basis for B2B e-invoicing. The B2B e-invoicing obligation is expected to start on 01.07.2024. |

| Portugal | In Portugal, eSPAP (Entidade de Serviços Partilhados da Administração Pública) is taking on the important role of coordinating body for the introduction of electronic invoicing. Mandatory since 2019, recognized formats to public administrations are UBL 2.1 "CIUS-PT" and CEFACT "CIUS-PT". |

| Romania | As of July 1, 2022, B2B deliveries of high-risk products must go through the e-Factura system, regardless of whether or not their buyers are registered in Romania's electronic invoicing registry. |

| Saudi Arabia | The first of the e-invoicing roll-out phases in Saudi Arabia (FATOORAH) started in 2021. The e-invoicing mandate includes "Standard Tax Invoices" for B2B and B2G and "Simplified Tax Invoices" for B2C transactions, as well as the debit or credit notes associated with each of the two invoice types. |

| Switzerland | Electronic invoicing in Switzerland has existed for more than two decades. Switzerland officially advises the use of a hybrid invoice format based on the German/French standard ZUGFeRD/Factur-X. |

| Serbia | Since 2022, e-invoicing is mandatory in Serbia for B2G and B2B. "Sistem E-Faktura" (SEF) is an IT solution for the Clearance e-Invoicing model provided by the Serbian Ministry of Finance for sending, receiving, capturing, processing and storing electronic invoices. |

| Slovakia | In Slovakia, the information and communication system for electronic invoices "Informačný system elektronickej fakturácie" (IS EFA) has been introduced for the exchange of electronic B2G and B2B invoices. Since April 2023, e-invoicing to public sector customers (B2G) has been mandatory. In 2024, B2B and B2C domestic transactions will become mandatory via IS EFA. |

| Spain | E-invoicing has been mandatory in the B2G sector in Spain since 2015. This is expected to be extended to B2B from 2024. The autonomous region of the Basque Country maintains its own tax system alongside that of the Spanish tax authority. With Ticket BAI, the Basque Country has introduced a new system for e-reporting invoices since January 1, 2022. |

| United Kingdom | Since 2019, electronic reporting of VAT-related data to HMRC (the so-called Move To Digital 'MTD' for businesses) has been mandatory in the UK. NHS suppliers and their suppliers are encouraged to use Peppol or GS1 standards for e-procurement, including e-invoicing. |

The challenge of global electronic invoicing

The guidebook for management and the Finance & Controlling department

Download guideInternational Standards for E-Invoicing: Peppol

Peppol is an open, cross-border network. Through a single interface, Peppol enables the exchange of electronic procurement documents with all partners registered in the Peppol network. Peppol covers not only electronic invoicing (e-invoicing) but the entire process of tendering and procurement (e-procurement). Peppol also supports the EU Directive 2014/55/EU on electronic invoicing in the context of public contracts (Public eProcurement).

To become part of the Peppol network, you need a connection to a Peppol Access Point. A Peppol Access Point takes on the role of both the sending and receiving access point, enabling the electronic exchange of documents such as catalogs, orders, shipping notifications and invoices.

Learn more about Peppol in our guide: What is Peppol?

Which Operating Model Is Optimal for Your E-Invoicing?

One of the preliminary considerations for the introduction of electronic invoicing concerns the mode of operation of the e-invoicing solution. Three strategic questions should be answered in advance:

Hosting:

Should the e-invoicing solution be located in your own data center or should the operation be outsourced to a data center operator?

Operating mode:

Should the solution be operated as a licensed product on-premises or as a cloud service on a pay-per-use basis?

Standards and formats:

Which e-invoicing standards and formats are currently needed and may be needed in the future

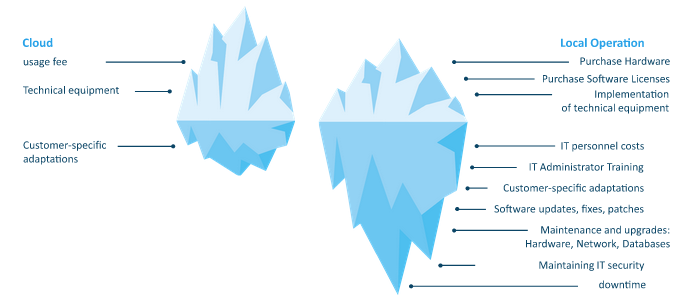

If maximum control over your invoicing and settlement processes is your top priority, the classic, license-based on-premises installation is a good choice. For the greatest possible flexibility, a cloud solution is a good choice. There is even more to be said for cloud-based invoice processing: fast implementation, simple integration and high operational security.

In contrast to flexible cloud operations, the overhead for an on-premise operation includes the acquisition costs of the hardware and software, as well as the implementation and technical setup. Don’t underestimate the running costs for personnel and maintenance with an on-premise e-invoicing solution.

Summary

In this guide, you have learned what an electronic invoice is and why e-invoicing is relevant today and in the future. The drivers of e-invoicing are the legislator and international regulations. But the many advantages, especially the cost-saving potential, also make e-invoicing an interesting topic for companies.

Manual outbound invoice processes are eliminated through digitization, thus immensely shortening the receivables cycle time through immediate delivery.

Digitizing incoming invoices increases processing quality, as manual errors can be avoided. Our data surveys also show that from as few as 12,000 incoming invoices per year, costs are reduced by up to 85% through the use of e-invoicing - compared to conventional manual invoice processing.

Internationally active companies face the problem of being able to support and process the different e-invoicing standards. The Peppol initiative could counteract this problem if it gains acceptance. To cope with the constantly changing regulations, the use of a cloud-based e-invoicing solution is recommended.

1Source: https://www.europarl.europa.eu/doceo/document/TA-9-2022-0082_DE.html#title1 (Date: 11.08.2022)